Who Else Wants Info About How To Start A S Corporation

Intel corporation) an intel factory employee holds a wafer with 3d stacked foveros technology at an intel fab in hillsboro, oregon, in december 2023.

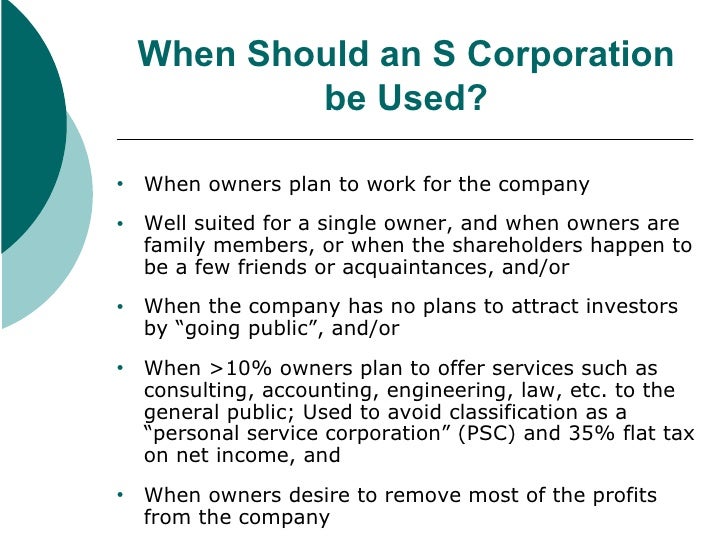

How to start a s corporation. Select a unique and appropriate name for your business that complies with your state's naming requirements. In order to start an s corp, a business must first have a formal business structure (i.e., an llc or corporation) and then elect to be taxed as an s corp. In february 2024, intel corporation launched intel foundry as the world’s first systems foundry for the ai era, delivering leadership in technology, resiliency and sustainability.

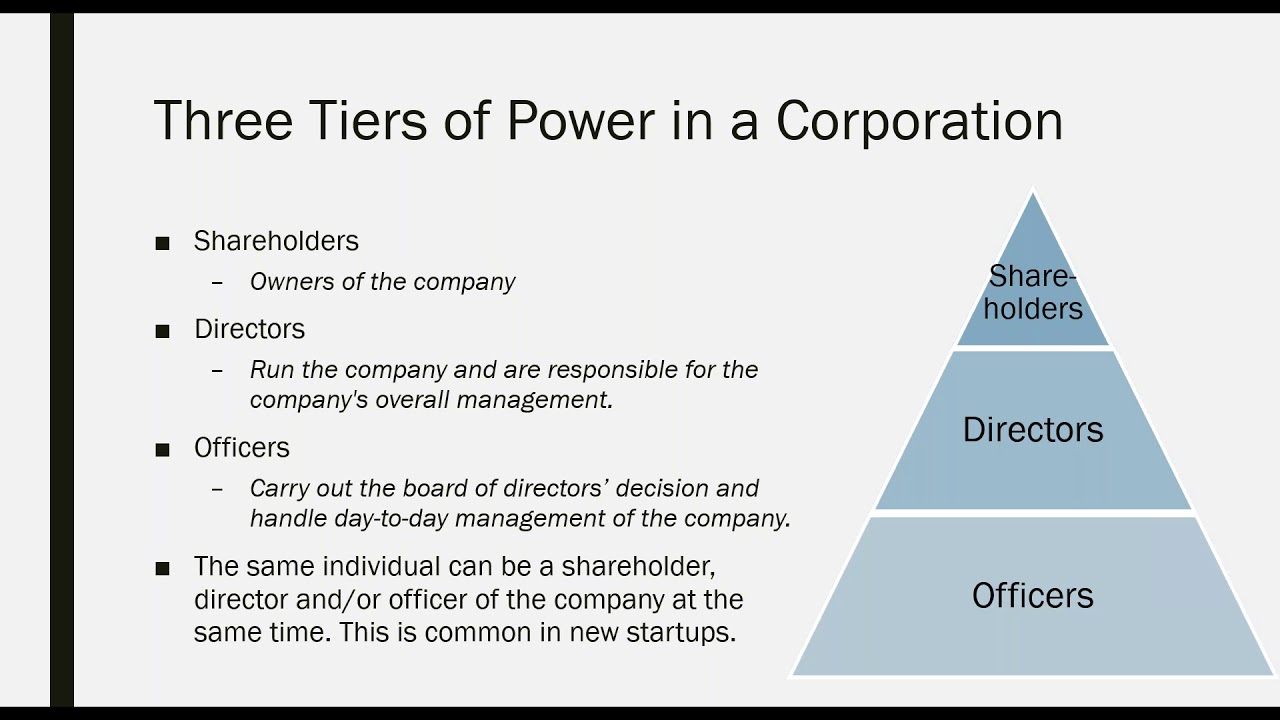

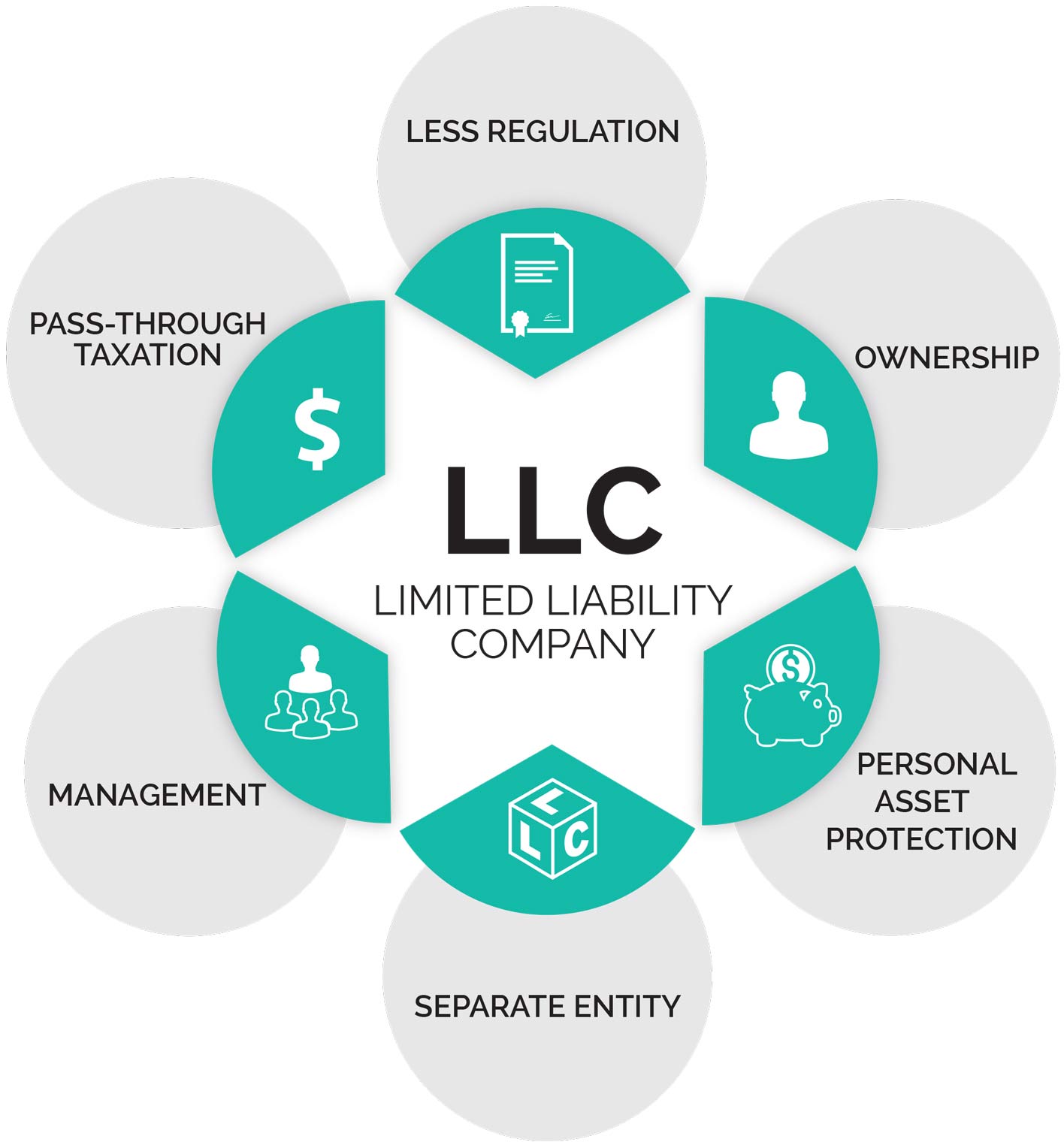

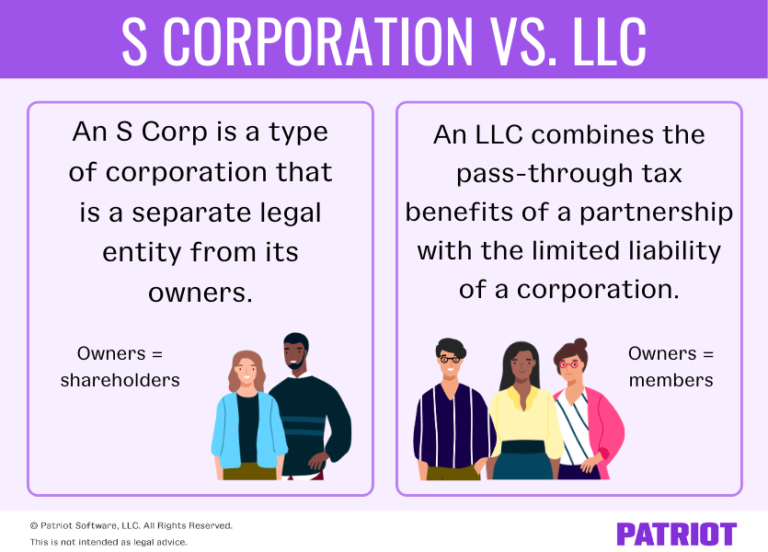

Open a corporate bank account Consider the different types of corporations a corporation is a business structure that allows owners to establish their company as a separate legal entity. An llc (limited liability company) is a business structure that offers liability protection while allowing for flexible management.

To find out if your business name is available, check your local secretary of state website. This only takes care of your tax status with the federal government, however. Define (and refine) your business idea.

Be a domestic corporation* only have allowable shareholders, including individuals or. This will include choosing a name, filing articles of incorporation with the secretary of state, paying any applicable fees, and following all. Have only one class of stock not be an ineligible corporation (i.e.

In fact, a good way to form an s corp is to start an llc, then convert it to an s corp. Ana swanson reports on trade from washington. Starting an s corp involves several steps to ensure that the company is properly established and compliant with legal and tax requirements.

An s corporation (s corp) is a tax designation that formal business entities like limited liability companies (llcs) and corporations may elect. This name may not be registered to any other business entity in the state. 1 pick your corporate name.

[2] your secretary of state’s website should have a database you can use to search. There are two main ways to start an s corp: Hold initial board of directors meeting 8.

For many businesses, s corp status provides significant tax advantages. Write your corporate bylaws 6. You’ll also need to file form 100s every year, and pay the annual $800 minimum franchise tax to maintain your status as an s corp.

Certain financial institutions, insurance companies, and domestic international sales corporations). The corporation can then apply for status as an s corporation. Starting your s corp is an exciting step toward structuring your business for success.

Incorporated companies enjoy “corporate personhood,” meaning that, like a person, they have the right to enter into contracts, loans, and borrow money. Submitting form 2553 is the final step to electing your business as an s corp. For some taylor swift fans, securing a coveted ticket to the australia leg of the superstar's eras tour was just the start of their stress — it was time to start curating the perfect concert outfit.

![5 Advantages of S Corporations [INFOGRAPHIC] The Incorporators](https://cdn.shopify.com/s/files/1/2954/2162/files/advantages-of-s-corporations.png?v=1541091194)