Best Info About How To Increase The Credit Score

Achieving good credit can take years but there are a few steps.

How to increase the credit score. Paying before the statement closing date on your account has the potential. There are four main ways to get your credit score: While a score that is at least 750 helps you get a loan on favourable.

When you pay your credit card bill early, it might help you earn a higher credit score. You can't have good credit if you don't. There’s not an exact answer to that, as each person’s financial situation is unique and complex.

Here are the ranges experian defines as poor, fair, good, very good and exceptional. Make your payments on time. Start by creating a realistic budget that.

A secured credit card can also help pad a thin file. Find out what your credit score is the first step is the easiest step. How do you improve your credit score?

But here are some things to. Develop a budget and stick to it. If you're looking to improve your credit rating, then a credit builder card can help rebuild your credit score.

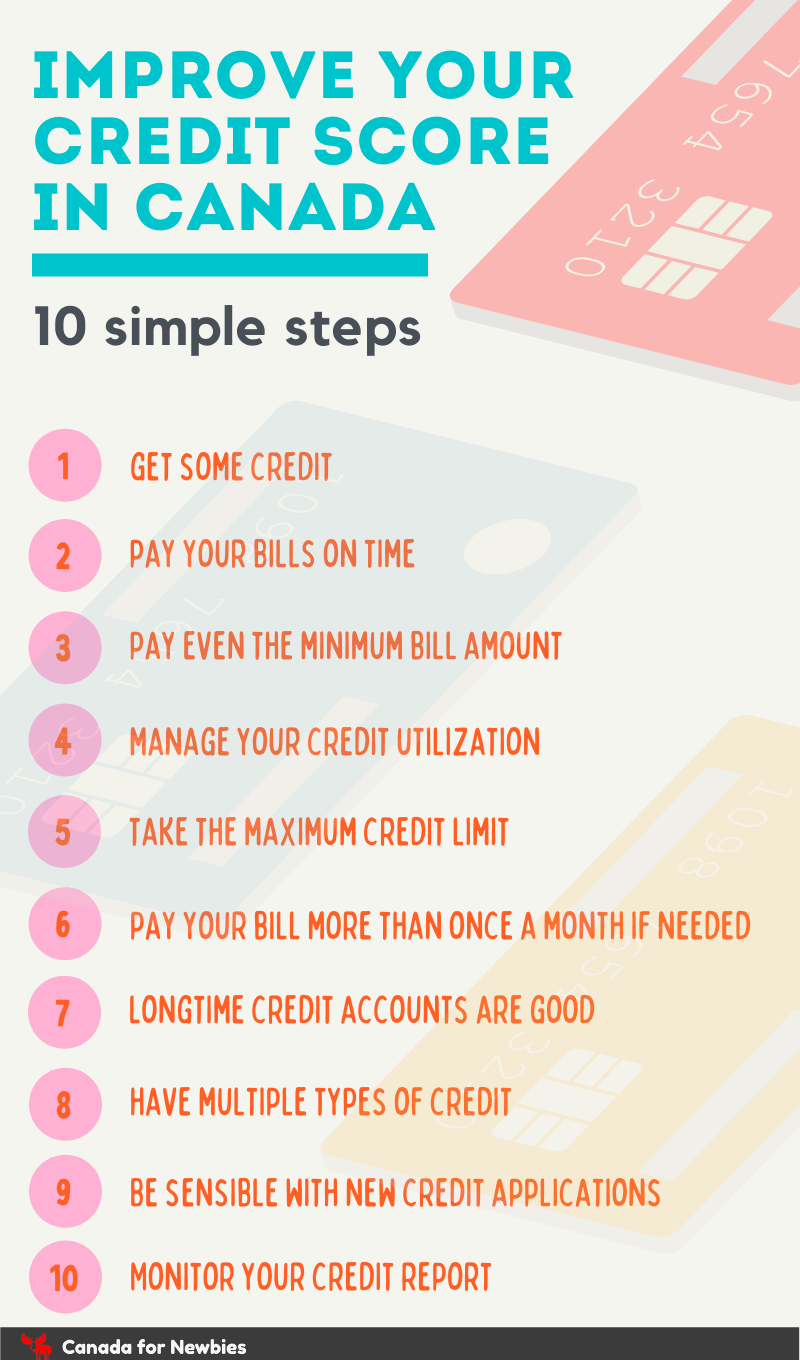

The best way to get your credit score over 800 comes down to paying your bills on time every month, even if it is making the minimum payment. They typically have low spending limits and high interest rates. Canada.ca money and finances debt and borrowing credit reports and scores improving your credit score from:

The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Private credit funds snap up corporate debt that’s trading well below its original value, or provide new financing to a company in difficulty, hoping to. You can’t work on something you have no knowledge of, so you need to gain access to your.

How to get your credit score. In this episode, claer gives emma’s credit score an mot with help from katie watts, a consumer expert at moneysavingexpert.com, and debt adviser sara williams,. Paying your bills on time is the most important thing you can do to help raise your score.

Talk to a credit or housing counselor. In general, depending on where you’re starting from and how you. Check your credit or loan statements.

The specific steps that can improve your credit score will vary based on your unique credit situation. Financial consumer agency of canada on this page monitoring. Taking control of your finances is another fundamental step toward fixing your credit.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)

![How to Increase Credit Score Fast [EASY TRICK] YouTube](https://i.ytimg.com/vi/L_XkMBJbjwA/maxresdefault.jpg)