Brilliant Tips About How To Deal With Irs Debt

Tax debt owed to the internal revenue service (irs) can be troublesome and frustrating to deal with.

How to deal with irs debt. Introduction dealing with debt can be overwhelming, especially when it involves the internal revenue service (irs). If you have a business and owe payroll taxes, you must pay them. You've likely seen and heard ads from companies claiming they can settle your.

Residents of alaska and hawaii should follow pacific time. You can reach representatives between 7 a.m. Take a personal loan.

But what many people don’t know is that they. After the irs notifies you it has accepted your offer and you pay the reduced amount you’ve agreed to, your entire tax debt is resolved if you fulfill the terms of the. If left unpaid, your tax bill can balloon and cause a huge financial headache, one that might be difficult to get rid of.

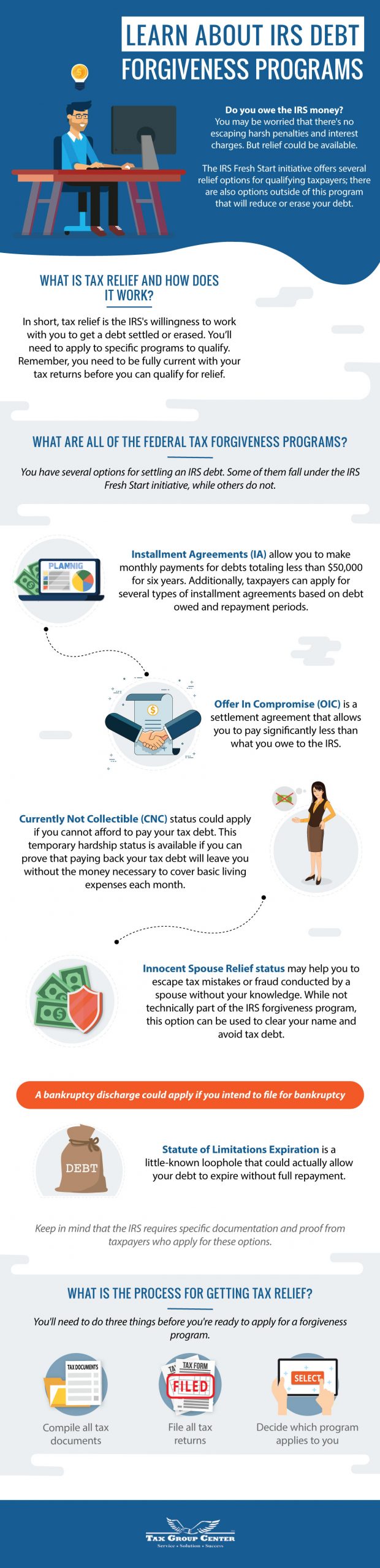

It allows you to settle your tax liabilities for less than what. Complete an application package: The irs is simply letting you know collection notices were suspended during the pandemic but are now.

You can kill your tax debts by filing bankruptcy only for income tax. Also, your income tax debt should be. The irs offers two options:

This lets you pay back what you owe over time. Local time unless otherwise designated. The irs won't call, text or contact you via social media to demand immediate tax payment.

The most common way to get rid of your tax debt is with an irs payment plan. If you don’t qualify for an irs offer in compromise, don’t fret. If you receive a lt83 notice, don’t panic.

If you cannot pay the taxes you owe in full, you should apply for debt relief. This allows you to make monthly. The irs’s offer in compromise program can be a lifeline for those sinking under the weight of tax debt.

Tax liens are legal claims by the irs to your personal or business property and assets due to back owed taxes. Set up an installment agreement if you owe less than $50,000 in taxes, you can contact the irs to set up an installment agreement. Settle irs debt by yourself, irs settlement, how to negotiate tax.

Few debts are as difficult to deal with as back taxes, so it’s. Keep in mind that the irs is generally more inclined to consider this option if there is doubt about the collectibility of the full debt. Offer in compromise the irs will sometimes consider a settlement that allows you to pay a reduced amount of what you owe in back taxes, which is called an offer in compromise.

/aa-Frank/IRS_Debt_Tax_Lien.png)