Lessons I Learned From Info About How To Buy I Savings Bonds

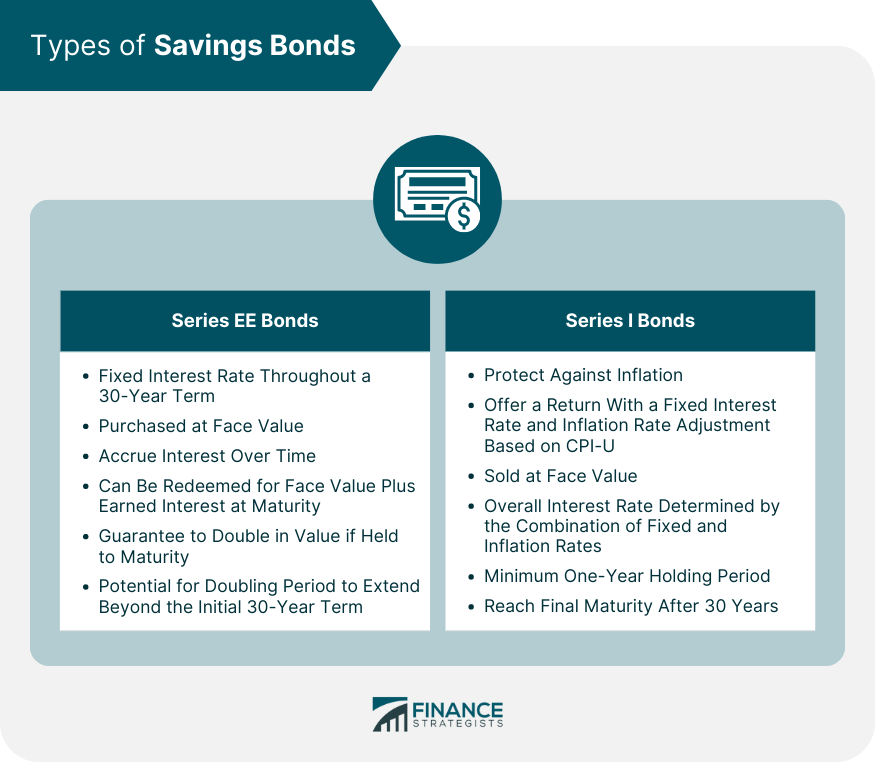

A fixed rate a inflation rate current interest rate series i savings bonds 5.27% this includes a fixed rate of 1.30% for i bonds issued november 1, 2023 to april.

How to buy i savings bonds. Investors can buy up to $10,000 worth of i bonds annually through the government’s treasurydirect website. October 31, 2023 / david baughier if you are looking for a way to save your money and protect it from the inflation americans are experiencing, you may want to consider. Buy savings bonds.

But like those who purchased six months. Learn how to buy u.s. These can be bought directly over the counter (otc) or via the asx through a broker or an online trading account.

Paper bonds can only be purchased as part of your irs tax refund. I bonds, also known as series i savings bonds, are a type of bond that earns interest from a variable semiannual inflation rate based on changes in the. But that’s just half the picture.

Most series i bonds are issued electronically, but it is possible to purchase paper certificates with a minimum of $50 using your income tax refund, according to. Lindsey bell, chief markets and money strategist for ally, says federally issued bonds. You can buy paper i bonds with your irs tax refund.

You can buy electronic i bonds on treasurydirect.gov or paper i bonds with your tax refund. Millions of americans rushed to buy i bonds in 2022 when a guaranteed 9.62% interest rate turned the staid government savings bonds into a bonanza. You can’t buy them from another.

I bonds should be balanced with other investments for a diversified. Also, using your federal tax refund, you can buy series i bonds in paper form. You can purchase another $5,000 with your tax.

About treasurydirect treasurydirect.gov is the one and only place to electronically buy and redeem u.s. You buy savings bonds, and the government will pay you a certain rate of. Savings bonds are federally issued debt securities.

As a result, thousands of americans snapped up i bonds during this period, earning 9.62% initially and then later 6.48%. In fact, the “i” in series i bonds stands for “inflation.”. Interest is compounded semiannually, meaning that every.

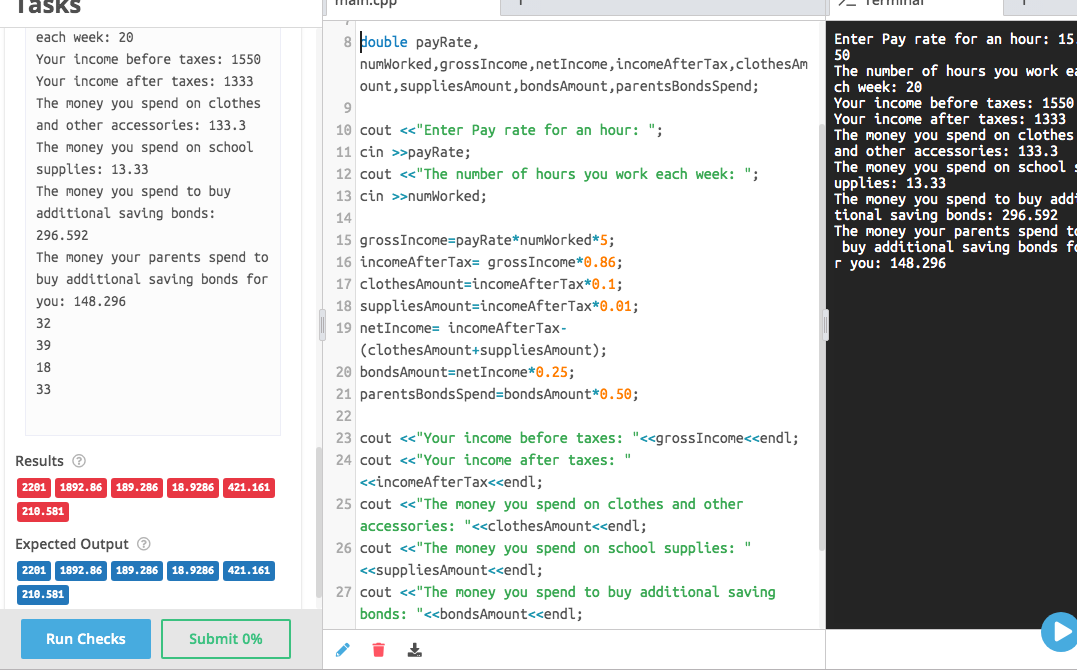

The face value of these types of bonds is fixed. How does an i bond earn interest? Both ee and i savings bonds earn interest monthly.

The minimum purchase amount for i bonds is $25, while the maximum amount is $15,000 in a calendar year—$10,000 in electronic bonds purchased from the. Monthly interest for i bonds is always paid on the first day of the month, and is not pro. Ee bonds you buy now have a fixed interest rate that you know when you buy the bond.

/Primary_Image-616e30d493ec4fbeacf21429f84617ea.jpg)

/HowDoIBuySeriesEESavingsBonds-565be2aa3df78c6ddf5df68e.jpg)