Underrated Ideas Of Tips About How To Build Fico Score

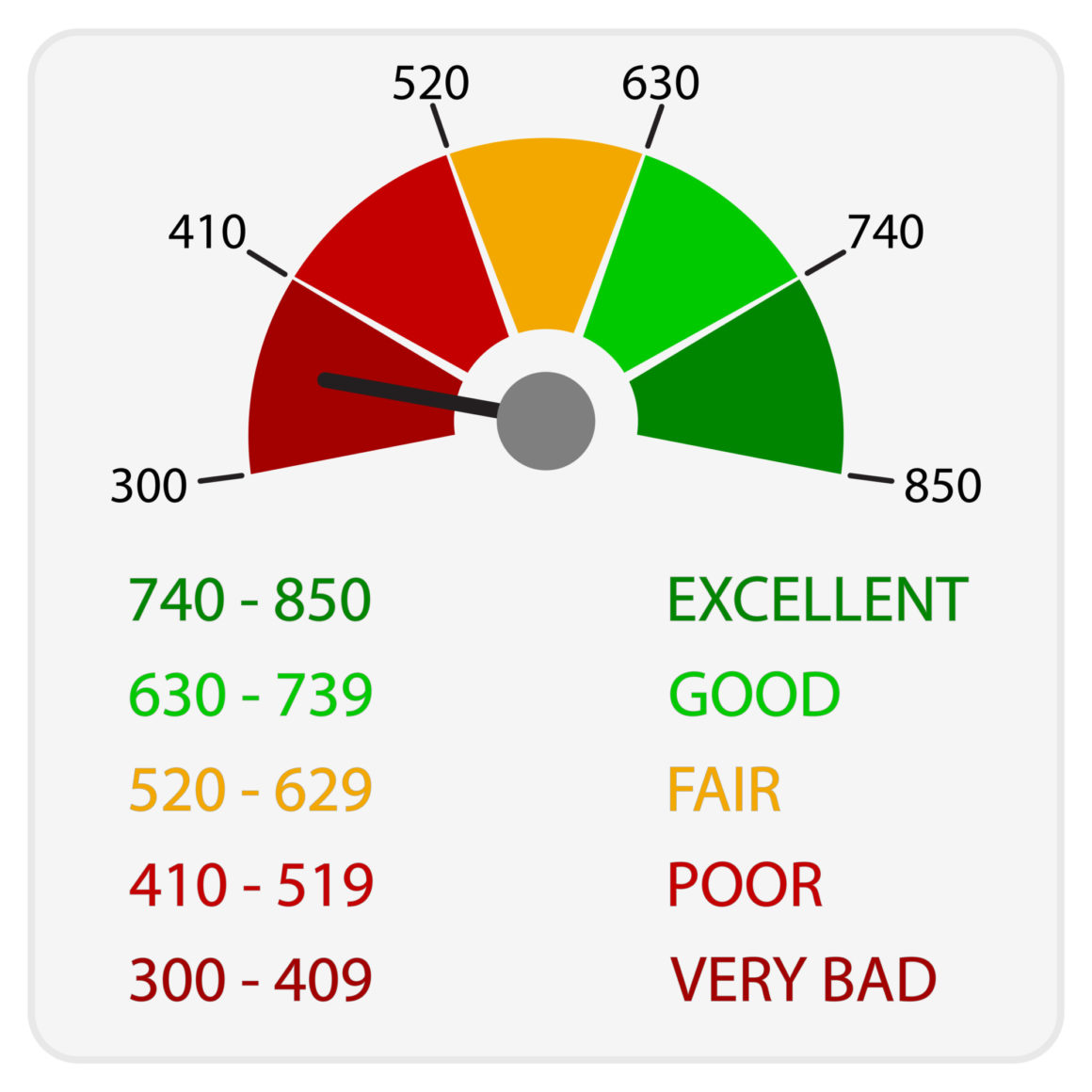

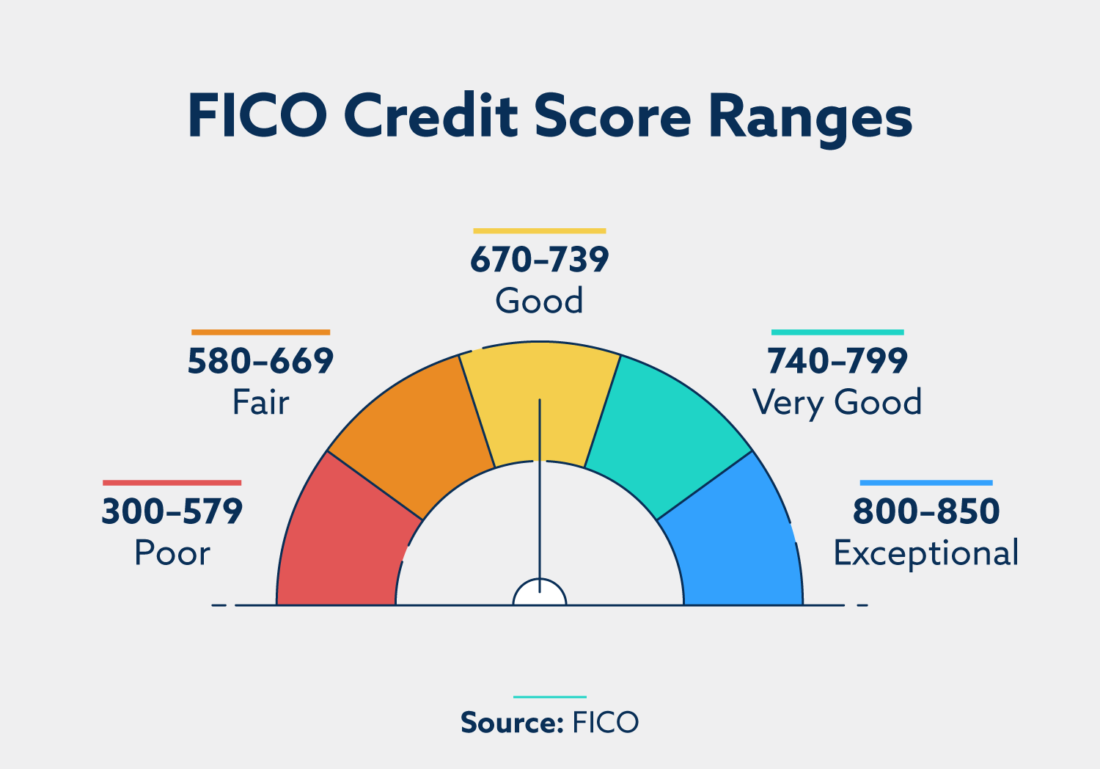

Fico scores typically range from 300 to 850, where lower scores equate to a higher risk of not paying bills as agreed in the future.

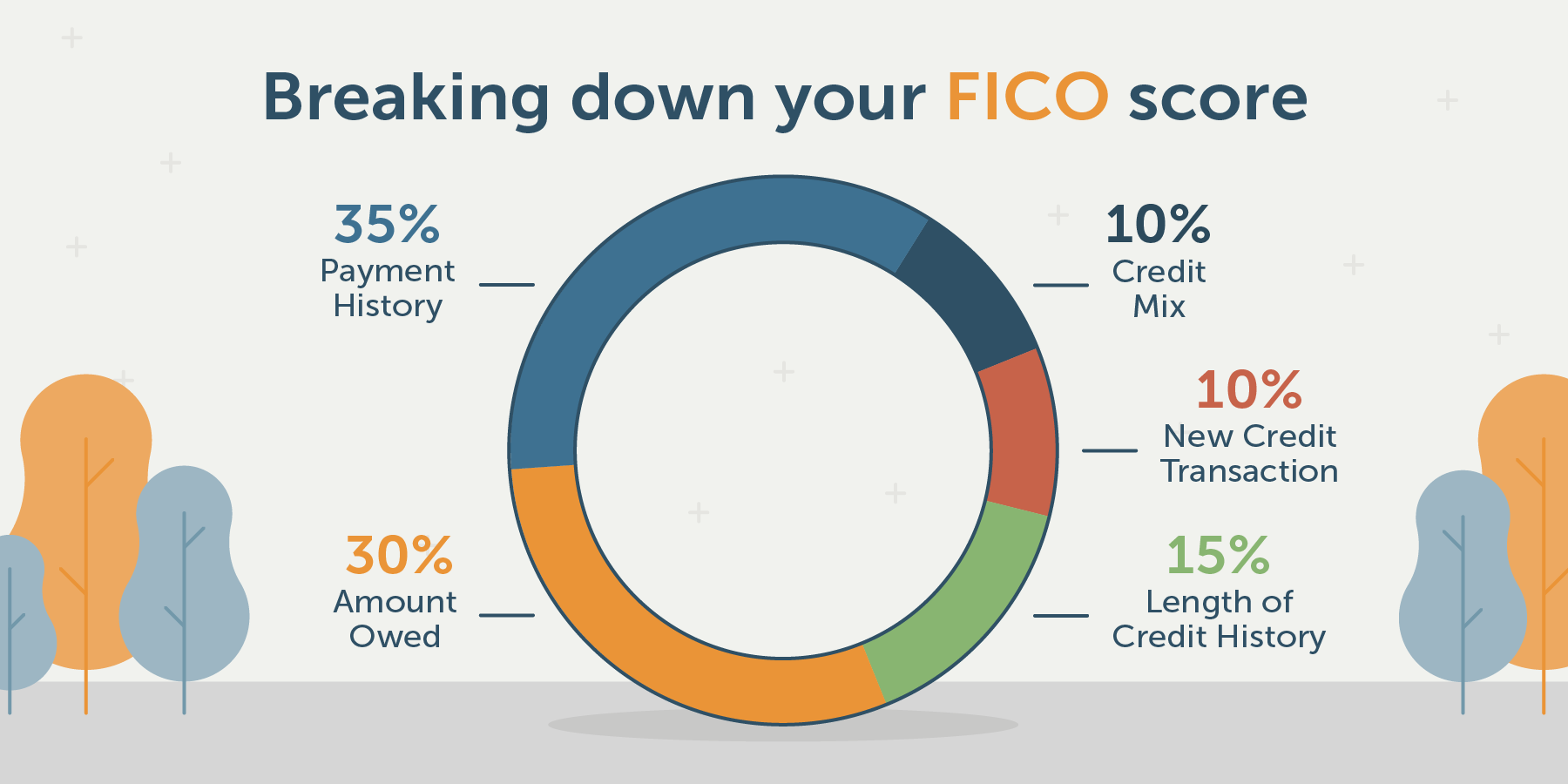

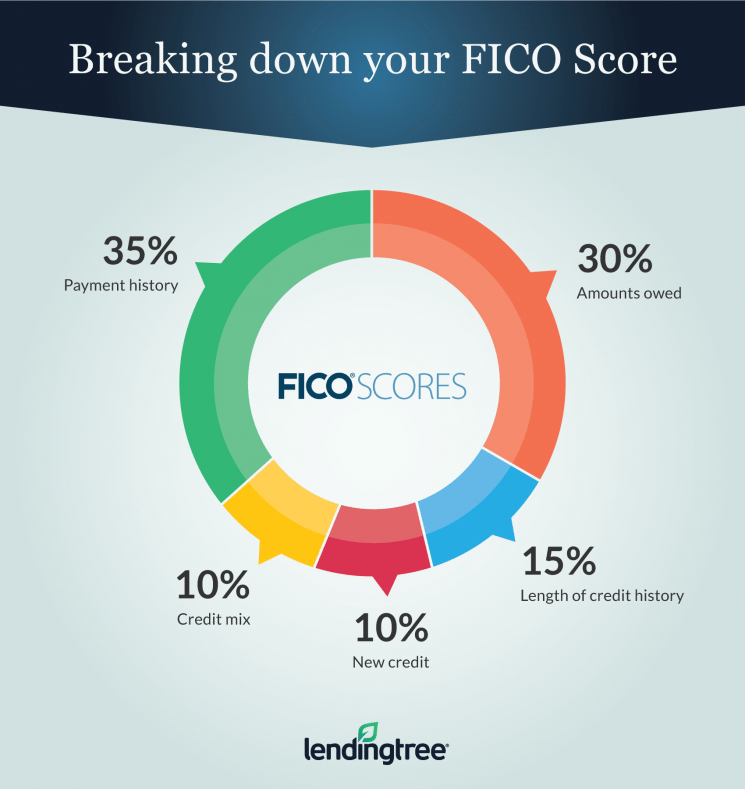

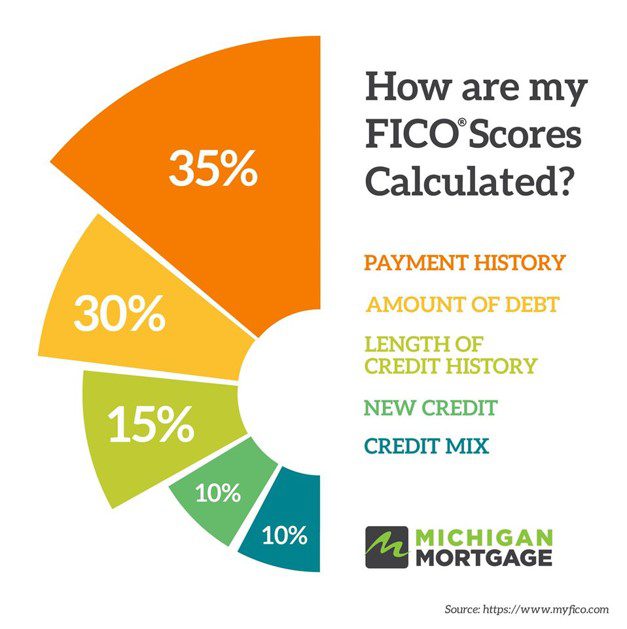

How to build fico score. From applying for a new credit card with attractive rewards, or a personal loan to cover a large expense, to getting a mortgage for a house or taking out a private student loan for college, your fico ® score plays a key role showing banks and other lenders that. Payment history (35%), amounts owed (30%),. Knowing the factors that affect your credit score helps you build or boost your credit.

Of the three credit bureaus, experian offers the best user experience. Getting even one late payment removed from your credit report can. This is your track record for making credit payments on time.

The main factors that affect your credit score include your payment history, your. You can improve your fico scores by first fixing errors in your credit history (if errors exist) and then following these. How a credit score of 700 stacks up.

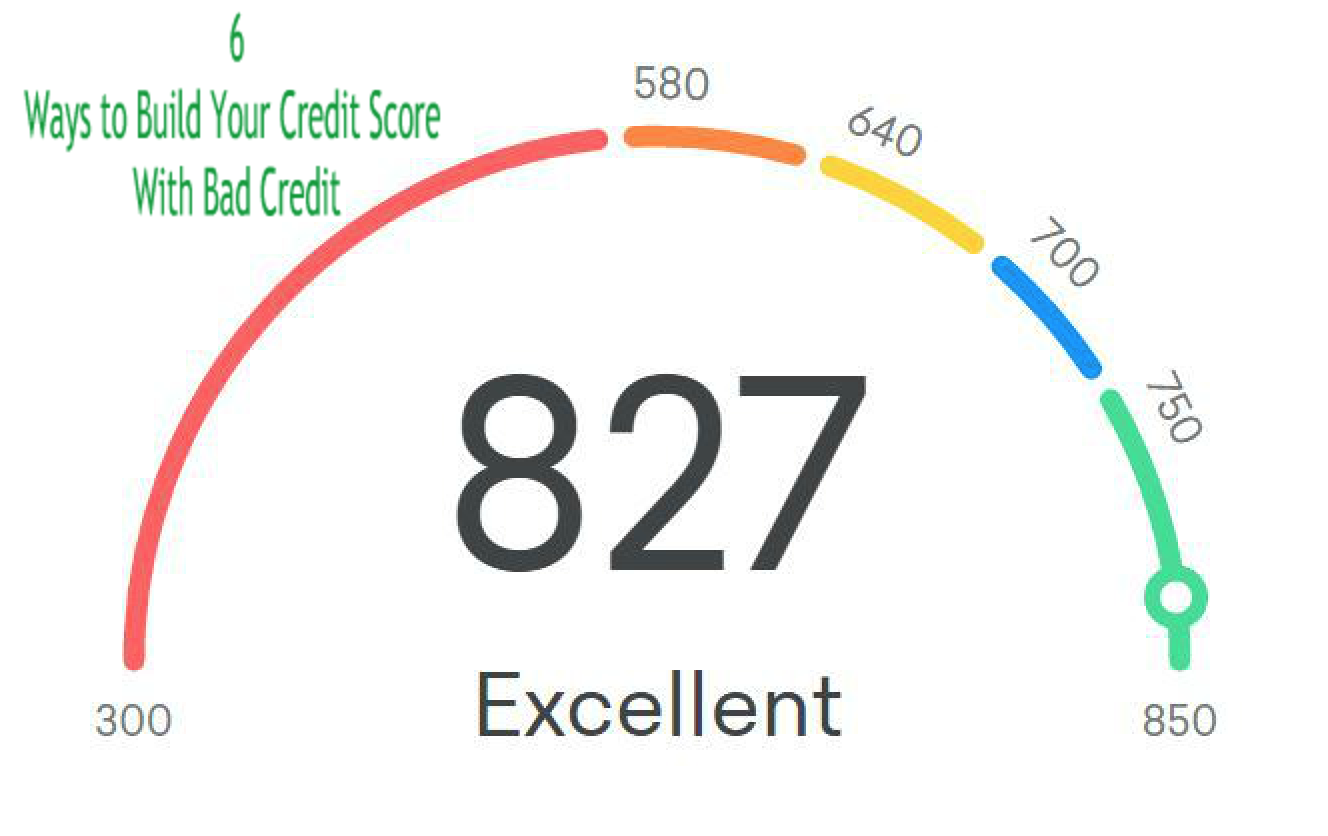

To get the best interest rates and be sure of qualifying for desirable loans, you should try to. How it compares to fico® score 8. How to improve your fico score achieving a high fico score requires having a mix of credit accounts and maintaining an excellent payment history.

Within 45 days, the credit bureaus will notify you with the results of your investigation. Experian, one of the three major credit. Settling the account will improve your score.

The fico score plays a vital role in risk assessment. Fico scores generally range from a low score of 300 to a high of 850. Fico® scores, the most commonly used credit scores, range from 300 to 850.

How to repair your credit and improve your fico ® scores. Fico scores are calculated using many different pieces of credit data in your credit report. Higher scores indicate lower risk, often leading to favorable.

There’s a premium membership for $24.99 monthly that adds benefits like a credit score. When you disputed it they updated their reporting to current and that tanked your score the 39 points. Fico score 10 t can enable an increase in mortgage originations of up to five percent (without taking on additional credit risk) and reduce default risk and losses.

Here are the ranges experian defines as poor, fair, good, very good and exceptional. To generate a fico ® score, you need at least one account opened for six months or more and at least one account that is reporting to the credit bureaus for the last 6 months. This data is grouped into five categories:

Fico scores are calculated based on five main factors: Influence over loan approvals and interest rates. Still, we know that when it comes to fico scores, the model used most often by lenders, there are five general categories of metrics, according to john ulzheimer, president of.

![[2019 ACTIONABLE TIPS] How To Build Your Credit Score C4D Crew](https://www.c4dcrew.com/wp-content/uploads/2019/05/credit-score.png)